Invest in the Veteran-Owned Bourbon Brand That's Growing 417% Annually

Founded by U.S. Veterans in 2023, On Your 6 Bourbon has quickly broken into the bourbon market by leading with authenticity and honoring those who serve.

- 417% year-over-year growth

- Successfully selling new accounts at 4X the industry average

- Sold in 170+ Kroger locations

- Replaced legacy brands like Maker’s Mark in multiple markets

- Partnered nationally with Caesars Entertainment, Folds of Honor, and more

Now, you can join us an early-stage investor.

180+ Celebrity Spirit Brands Later... Consumers Want the Real Thing

As of late 2025, the spirits market is saturated with over 180 celebrity-owned or endorsed alcohol brands, a more than 4X increase since 2018. More than half are whiskey or agave-based.1 At the same time:

90%

of consumers value authenticity when choosing which brands to support.2

85%

of American consumers find patriotism “very” important.3

90%

of consumers say they would switch brands to one associated with a good cause.4

A Whiskey That Serves Those Who Serve

Founded by two U.S. Veterans, OY6 honors the everyday heroes who keep this country going. Nurses. Firefighters. Police Officers. Teachers. First Responders. And this whiskey shows up for them.

Kroger, Caesars, and 417% YoY Growth

We land over 80% of the retail accounts we pitch, 4X the industry average. Once on shelves, bottles move fast, and stores return for more.

417% YoY growth

in 2025, with Q1 2025 alone earning 74% of total 2024 sales

In 170+ Kroger stores

including the bourbon-obsessed Kentucky region

Partnered with

AVAILABLE AT

over 1,600 accounts across 27 states and online at onyour6.com

REPLACING BRANDS

like Maker’s Mark on the shelves in some stores

How We Found Breakout Success

Most new brands are slow-moving. We found what works in a crowded market and scaled it fast. Here's how we outpace the category:

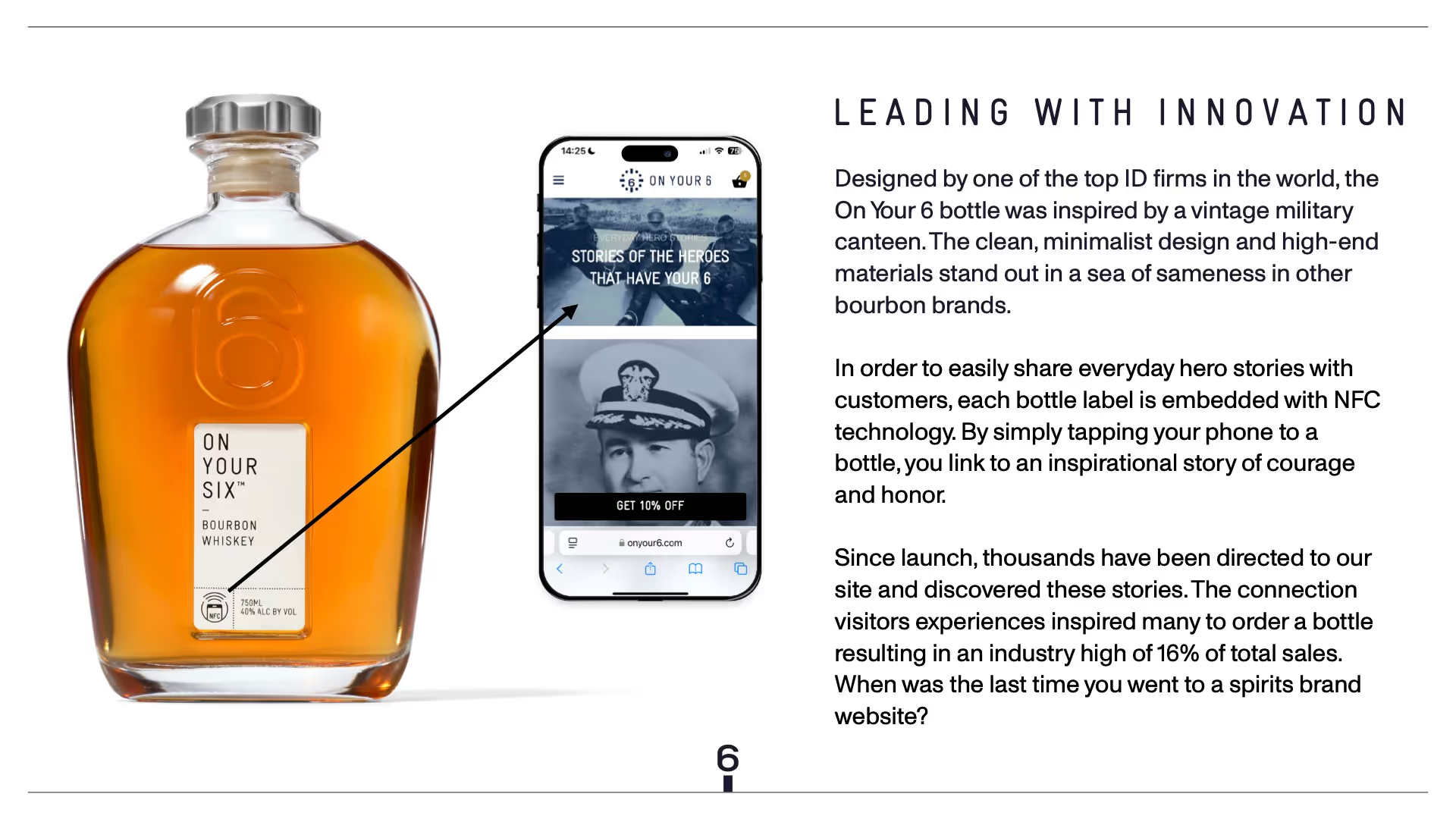

Crushing eComm norms

6.5% of sales are D2C online, 4X the industry average

Priced for the moment

Award-winning in the increasingly popular $30-$44 range

EMOTIONAL STORYTELLING

Always-on digital storytelling creates deeper emotional pull

Mission that moves bottles

Veteran-founded, service-driven brand wins consumer trust

Team with proven access

Leaders from Diageo, Kroger, Apple, Comcast & more

Our Road to 30X Profit Growth… or Acquisition*

The funds raised will power our expansion from 2,747 cases sold in 2024 to 50,000+ by 2027, fueling 30X gross profit growth. In coming months, we’ll increase our Kroger presence from 170+ stores to more than 300. Meanwhile, the bourbon category has a proven exit playbook, with acquisitions regularly happening at 10X+ revenue multiples. For example, Proper No. Twelve sold for $600M at 17.9X sales in 2021.

.webp)

Black Rifle Coffee: Proof This Approach Works

In 2014, Black Rifle Coffee launched with a simple idea: build a premium coffee brand that celebrates Veterans and American values. It cut through a saturated CPG category with content, community, and mission, going public in 2022 at a $1.7B valuation. We’re following this same proven playbook in a category with deeper spend and stronger acquisition trends**.

Get the investor deck

Exclusive Investor Perks

Unmatched Military and Brand Acumen

From US Veterans to spirits industry Veterans, our team brings deep experience, proven exits, and the creative horsepower to build a breakout brand.

• U.S. Veterans, deeply embodying the mission and values of On Your 6 Bourbon.

• Serve as the soul of the mission and stewards of the On Your 6 Foundation, emphasizing support for service members and first responders.

• Foundational leaders driving brand authenticity and community engagement within the veteran and service communities.

• Strategic leader with over three decades of experience scaling national brands, including state-level advocacy and navigating complex regulatory environments.

• Co-founder and CEO of On Your 6 Bourbon, a mission-driven brand honoring everyday heroes, with distribution in 28 states within 18 months of launch.

• Co-founded The Griffin Company, a premier government affairs firm in Nevada, representing major business, tech, gaming, and energy clients.

• Former operator with multiple successful spirits exits, including Deep Eddy Vodka, bringing deep operational expertise and industry insight.

• Oversees day-to-day operations to maintain high standards in production and market growth.

• Instrumental in scaling On Your 6 Bourbon in the competitive spirits market.

• Experienced in premium loyalty programs, multi-platform social media campaigns, eCommerce leadership, and marketing strategy for spirits and lifestyle brands.

• Guides the brand's marketing strategy to strengthen customer connection and market presence.

• Founded the spirits marketing firm Legal Drinking Agency, providing a deeply rooted industry network

ran and service communities.

Strategic finance executive with nearly two decades of experience scaling premium spirits brands and leading financial operations.

• Former Head of Revenue Growth Management for Reserve & Incubation, Europe, division and Commercial Finance, GB On-Trade, at Diageo, home to Johnnie Walker, Don Julio, and Guinness.

• Held global leadership roles at Stoli Group and Russian Standard Vodka, bringing deep expertise in commercial strategy and operational excellence.

Frequently Asked Questions

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of On Your 6 (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities;

• An accredited investor;

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships).

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.